Exclusive Offer for MoneyMagpie Readers

MoneyMagpie readers can get a copy of the full book with easy-to-follow, step-by-step instructions on how I set up a low-cost, low-maintenance portfolio with the appropriate level of risk.

And, if you mention MoneyMagpie in the delivery instructions, you’ll also get:

Free copy of the 14-page guide, How to Select a Good Financial Advisor

PLUS

Transcript of the Q&A session David did with Jasmine, including his answers to your questions

You CAN take control of your investments and save 90% in costs

It’s not as frightening as the people in the investment industry would like you to think. I’ve explained every part of the process in simple, baby steps.

Just mention “MoneyMagpie” in the delivery instructions when you place the order with Amazon. The book costs £14.93 plus P&P.

Click here to buy the physical book on Amazon

PLUS When you mention MoneyMagpie in your delivery instructions:

Free 14-page guide, How To Select a Good Financial Advisor.

PLUS

Q&A Session transcript including answers to your questions

Remember to mention MoneyMagpie in your delivery instructions.

For £14.93 here

The book includes:

- The 4 investment websites I would use and some of the many I would avoid

- The questionnaire you can use to help select an Advisor

- The full risk questionnaire that I use to identify the right level of risk for investments

- Step-by-step guide showing how I select funds for my low-cost investments

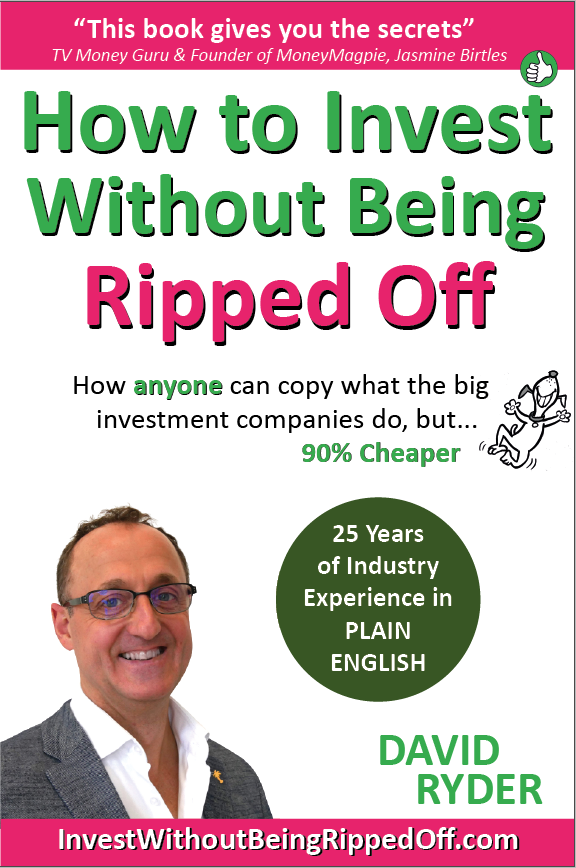

More details from the book cover:

David Ryder draws on his 25 years in the financial industry to show how he sets up simple, low-cost investment portfolios that largely look after themselves.

He also reviews, in detail, a broad range of investment companies, and tells you which investment companies he would use (not many). Most of them are too expensive or too limited in what they offer. In fact, many of them were so bad that there was no point in including them in this book.

He demonstrates, with his own money, how he:

- saves more than 90% on fees

- copies the investment choices of the big investment companies.

David speaks in plain English with humour to expose the ways in which you are being ripped off, and how it’s possible to take simple steps to hang on to more of your hard-earned money.

The website InvestWithoutBeingRippedOff.com provides updates and additional information, including how David’s real investments are performing and what the actual costs are that he’s paying.

You can read How to Invest Without Being Ripped Off from cover to cover, or dip into it to get the particular information you need, it’s up to you.

Either way, use this book to help you keep your money and have your investments work for you, not the other way around.

Please support what I’m doing and arm yourself against being ripped off.

Thank you,

David.