Before Investing

Here are some simple steps to follow to get your finances in order before investing:

On this page:

Write down your financial goals and aspirations

Assess your financial situation

Clear “bad” debt

Avoid this expensive mistake

Check your state pension

Set up a cash buffer

Getting advice

Next steps

Write down your goals and aspirations

These don’t have to be massively ambitious. It might be that you want to be able to put a deposit down on a property, pay for education, cover later-life health costs, pass on some inheritance, set up a decent retirement fund or buy a particularly seductive turnip. Until you write them down, it’ll be harder to create a simple plan on how to get there and turn them into reality.

Assess your current financial situation

This is possibly the most important step you need to take to improve your financial future.

It’s a simple thing to do and yet you might be daunted at the prospect. Don’t be. It takes a bit of time and effort, but it’s simple and 100% worthwhile.

Make a list of:

- Your income/ benefits/ salary/ rental income, etc.

- Your outgoings/ expenses/ mortgage payments/ food/ insurance/ MOT, etc.

- Your cash/ investments/ pensions/ Individual Savings Accounts (ISAs)/Self-Invested Personal Pensions (SIPPs), etc.

You’ll find free budgeting advice and ready made tools on these impartial, government-funded websites:

These sites consider a broad financial remit including money troubles, benefits and family care. They contain some good articles on pensions and savings.

If you ever need an entirely neutral, reliable source of information, I’d recommend them. They can even offer free counselling and advice for people struggling with finances.

What your list tells you

Take the time to dig out your bank and credit card statements, investment statements and other information that you need to be as comprehensive as possible.

When you’ve completed the spreadsheet, you’ll:

- Know what your current financial situation really is

- Be able to prioritise what to do next

- Be able to plan how to achieve the financial goals that you want

- And, most of all, eliminate the worry and stress related to bills, money and investing.

Clear “bad” debt

In broad terms, I consider the mortgage on your home to be a “good” debt. I consider more or less everything else to be bad debt.

Why is good debt good?

A mortgage can provide somewhere to live and a form of long-term investment. Depending on your circumstances, it can make sense to maintain payments and not pay the mortgage off early. As always, this is just a general rule of thumb; your specific circumstances will determine the precise action you should take.

I no longer include student loans as good debt because the interest rates on them have been hiked up horrendously. While it might be advantageous to career prospects, it’s money I’d want to clear fairly quickly.

The rest is bad debt

Other forms of debt are generally a bad thing. I’m thinking of:

- Store cards

- Credit cards

- Overdrafts

- Loans

- Hire-purchase payments on things you don’t really need

- Payday loans (you should simply never use these. However, if you are using them, get help now from the free online resources suggested a little later in this section and again in the Useful Resources at the back of this book).

I cleared these debts before I started investing or saving.

Rip-off Tip-off – Avoid Loan Consolidators

Rip-off Tip-off – Avoid Loan ConsolidatorsWhatever you do, DO NOT go to any “loan consolidators” or anyone else who advertises on TV or radio, or in magazines. If they can afford to advertise then they’re getting the money to do so by ripping people off.

Avoid this expensive mistake

Some people have both savings and “bad” debt. That can be a big and expensive mistake.

Here’s why.

These debts charge high interest, usually far more than you’re going to earn through savings.

Don’t kid yourself that it’s nice to have savings when you also have the sort of debts that I’ve listed below. It’s an expensive mistake.

Hypothetical example of savings that cost you money

You might be holding £1,000 of debt on one hand which charges an average of, say, 15% a year (though it’s probably more—I was paying 29.8% on my credit card until I moved it to a cheaper loan and paid that off).

Meanwhile, the £1,000 in savings that you hold probably pays less than 5%.

In other words, you’re maybe earning £50 a year BEFORE TAX on your savings and paying £150 a year in interest payments on your credit card. That nice-to-have-savings feeling is costing you £100 a year from your after-tax earnings.

In essence, you’re subsidising the credit companies. Don’t fall for it. Clear that debt.

If you can’t pay them all off, consider:

- Moving the ones charging the highest interest rates to lower-interest rate options

- Paying off the most expensive ones as quickly as possible

- Using the free resources mentioned below to help you get your debt under control.

Check your state pension

If you’re living in the UK, the chances are that you’ll be entitled to a state pension. At the time of writing, the state pension provides up to £179.60 per week. That might not sound like much, but don’t dismiss it: it’s actually very valuable.

State pension vs salary

To take home £180 a week from a salary, you’d need to be earning a gross annual salary of around £9,300. Imagine someone offering you a £9,300 annual pay rise right now in return for which you just have to stay alive. Would you refuse?

State pension vs annuity

The value of the state pension even more striking when you compare it to an annuity, i.e., a financial product that pays you an amount each year depending on such factors as:

- How much money you commit upfront to buy the annuity

- How long you want the annuity to last

- If it will rise with inflation i.e., if it’s “index-linked”

I like to think of the state pension as an annuity which is index-linked and indefinite – it only stops paying once I’m no longer around to collect it.

Insurance and investment companies will sell annuities. But they do it to make a profit. That means that you would have to pay a heart-stoppingly hefty sum to get an annuity that would pay £180 a week, rise with inflation, and continue until death do you part.

How hefty? Perhaps around £200,000 for a 55-year-old or maybe less if you’re older.

Yep, from the conversations I’ve had with financial advisors, an upfront payment in the ballpark of £200,000 could be required to generate the equivalent of the UK state pension. Which makes the state pension one heck of a gift horse.

Rip-off Tip-off – “Free” annuities

Rip-off Tip-off – “Free” annuitiesYou might find advisors who offer to arrange an annuity “for free”. Don’t be fooled, it ain’t. The commission that you’ll pay indirectly can be nothing short of outrageous.

Frightening data

According to data from the FCA (the organisation that polices the finance industry), the average pension pot of UK individuals at the age of 55 is just, wait for it, £62,000.

This tells us many things, including:

- The majority of people have nowhere near enough for retirement

- The state pension is massively important to most people.

Checking your UK state pension online

The UK government state pension website provides useful and easy-to-follow steps on:

- How much pension you’re entitled to

- When you can retire

- How to increase your state pension entitlement.

Follow the instructions on the website to set up an account (it’s fiddly but worth it).

Once you have an account, you’ll be able to find out how much your state pension is likely to be at retirement. The figure will depend on a number of factors, most important of which could be the National Insurance (NI) contributions you’ve made to date. Currently, you need to have made 35 years of NI contributions to receive a full state pension.

If your state pension pot is not on target to hit full value, then seriously consider making some extra contributions to boost it. It’s one of the best-value pensions in my opinion.

HOWEVER, you should be aware that the government is pushing back the retirement age, so you might not be entitled to collect a state pension until you’re 67. The reason is obvious. As people live longer, the cost of pensions is proving too much for the public purse. Something has to give, and, with most folk reluctant to pay more tax or NI contributions, the cost of pensions is being managed by postponing the date on which the payments can kick in. Nevertheless, I keep a close eye on my NI contributions to make sure that I’ll be entitled to the full state pension. For me, it’s too good an offer to miss out on.

Set up a cash buffer

Being unprepared for the unexpected is one of the biggest failings of folk in the UK.

For how long would you be able to manage financially if you suddenly lost your job or your ability to earn money? For most people, the answer is probably around three months. That’s a very vulnerable position.

The following are the sorts of things that life throws at us all at some point or another:

- Unemployment

- Illness/ accident

- New washing machine

- House maintenance issues

- Car breakdown

- Divorce

The emotional pressure of these events is enough to deal with, let alone having the additional stress of managing the financial implications.

When you encounter one of these events, your normal cash flow is bound to be disrupted. As a result, you’ll probably find yourself needing some money to tide you over until things settle down.

If you don’t have a cash buffer, you’ll end up having to dip into your investments or, worse still, borrow money. Selling investments at short notice is expensive because:

- You’ll probably have to sell investments at short notice, which means you’ll get a poor price for whatever you’re selling

- You’ll incur trading costs

- You may also incur transfer/extraction costs.

As a consequence, that £5,000 which you need immediately will actually cost you more like £5,500 or more, AND it will take you months to rectify the damage done to your investments.

Don’t let that happen to you.

Set up that cash buffer. You’ll be glad you did, if only for the fact that it massively reduces stress and worry.

After you’ve cleared your bad debt, work out how much your monthly outgoings are and start saving three to six months’ worth of cash.

How much do you need?

Look back over your expenditure for the past six months. Your bank balance should provide you with most of the information you need. Make sure you allow for things that you pay for annually but which did not fall during that six-month period (e.g., annual insurance, school fees, holidays, Christmas, council tax and so on).

Work out how much your expenditure is over that period. That’s a good target to have as a cash buffer.

With a cash buffer in place, I’m much less likely to fret about the ups and downs of my investments. Similarly, if something bad happens, I’m in a position to pay for emergency healthcare or to cover my expenses after being made redundant.

Example with numbers

The median weekly pay for full-time employees was £640 in April 2022, according to the Office for National Statistics. That equates to about £33,280 a year. There is massive variation on this, though, depending on age, gender and location. And that’s before we think about the different areas of work that you might be engaged in.

A ballpark figure for the take-home pay (after tax and NI) from £33,280 is £26,650 in the 2023-2024 tax year. To keep it simple, I’m going to think of six months’ worth of this as £12,000. So, when I talk about the cash buffer, I’m going to use £12,000 as the figure. Your figure is likely to be different from this but it’s a good number to use by way of example.

What do you do with that money?

The point of the cash buffer isn’t to make money, but to have readily available cash in the case of an emergency.

The simplest way of doing this is to put the cash buffer into a savings account.

The rate of interest is probably not going to be very good. In all likelihood, it’ll be lower than inflation (the rate at which prices for goods and services rise). The consequence of this is that, even though the total number of £12,000 will remain largely unchanged, what it can buy over time will fall.

But that doesn’t matter because my priority is to have cash readily available. If I were particularly worried about inflation, I’d just add another 15 days’ worth of cash to the total, making it a six-and-half-month buffer.

The next step is to forget about it. It’s there doing its job of being my cash backup should I need it. That allows me to sleep easy, and that’s really what this book is all about: peace of mind.

Use the UK government’s guarantee

I’d make sure that the bank with which I’m placing the buffer is covered by the Financial Services Compensation Scheme (FSCS).

That way, should the bank I’ve put the money with go bust a la Northern Rock, I’d get my money paid back to me by the government up to a total of £85,000 (at the time of writing).

There is one caveat to add to this, and it’s important. The FSCS guarantee of £85,000 applies as a total of all your holdings under a banking licence, which can include more than one company as you and I see them.

By way of example, Clydesdale Bank, Virgin Money and Yorkshire Bank are all covered by the same banking licence, so the £85,000 FSCS guarantee includes everything I might hold across all three in total.

The Bank of England provides a list of banking companies according to their respective banking licences.

If I were lucky enough to have £85,000 across all of them, then I’d be looking for a banking group covered by a different banking licence in which to place anything over the £85,000.

That said, I’d be surprised if too many people would need an £85,000 cash buffer!

Return to the top of the screen

Getting advice

Here are some insider tips on how to find a good financial advisor and how to avoid the glorified salespeople who call themselves advisors.

What To Ask An Advisor

What To Ask An AdvisorThe comprehensive What to Ask An IFA questionnaire and scoring system come with the full ebook if that’s of interest (see purple box at the top of this screen)

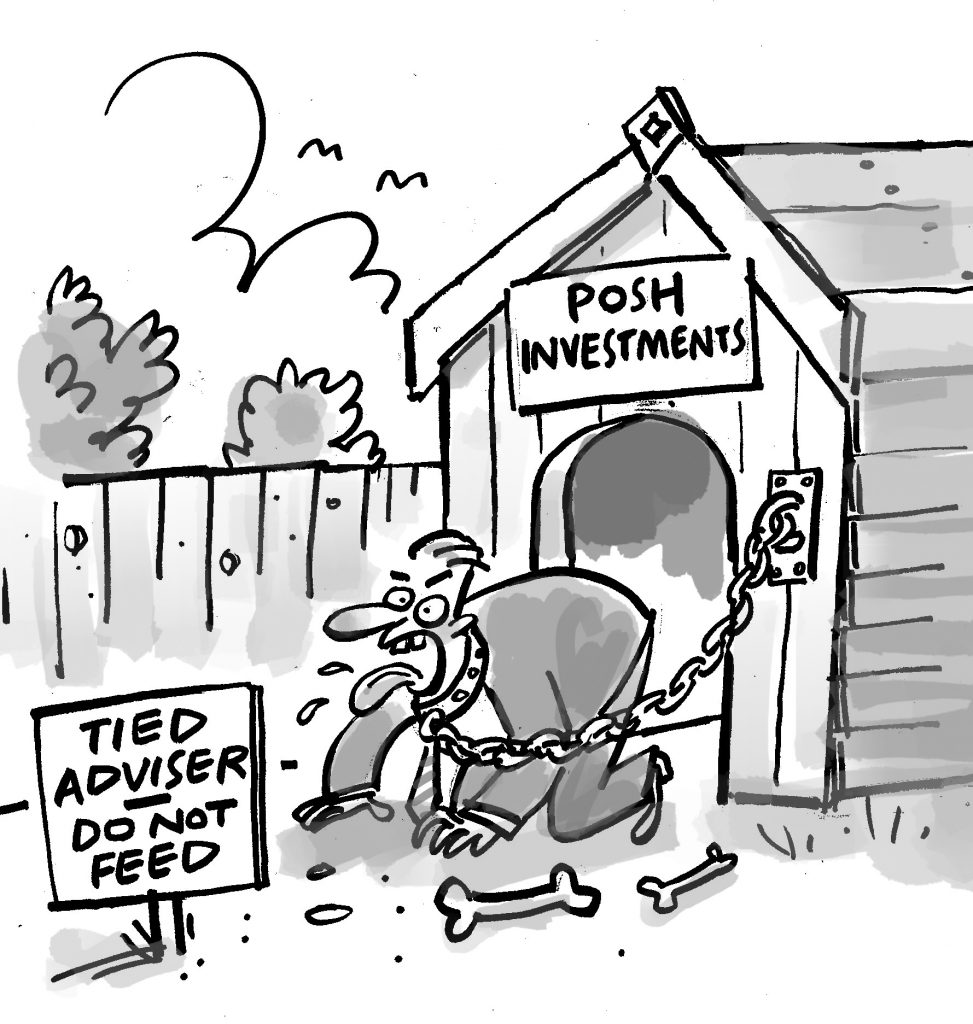

IFAs who offer whole-of-market coverage are not tied or restricted to what one bank or investment firm offers. They look across the entire range of what’s available and try to pick out what should work for you in your unique circumstances.

They charge for their services and rightly so. From what I’ve heard, at the time of writing, IFAs charge approximately £200 per hour with the expectation that they’ll spend around three hours with you and then charge for another four hours’ work. That hourly rate goes up to £250/£300 per hour for a chartered IFA.

Unhelpfully, they tend not to be interested in investors with less than an overall total of £100,000 to invest. Don’t be surprised then, if you have to fork out £1,000-£1,500 for upfront financial advice.

Not all advisors are equal

A wealthy friend of mine faced this with an IFA who wanted 1% of his pension pot annually for what seemed to me to be not much value. After a year or two of this, my friend agreed with my perspective and stopped the ongoing advice as it wasn’t adding much value and certainly wasn’t worth 1% of his pension pot each year.

The problem is finding a good IFA with experience and total integrity. If your investments are set up properly in the first place, you shouldn’t need much advice after that unless your circumstances change. I start to question some IFAs when they want to charge an annual fee for ongoing advice.

Tips on finding a good advisor

Here’s what a qualified and trustworthy advisor said to me: “A good financial advisor will get you some good returns. A great one will help you achieve your goals and build a plan for you to do that.”

IFAs don’t just cover investment decisions. They also provide things like inheritance tax planning (very worthwhile) and insurance. For some reason, they insist on calling insurance “protection” which always puts me in mind of an activity with a rather different risk-reward consideration.

And we’re back in the room. So how do you find a decent IFA?

You could consider one that’s “chartered” or a “fellow”. This means that they have put in the graft to get additional qualifications and that they have relevant experience that’s been verified. Better still, you could look for a chartered IFA firm i.e., one in which the whole business sets its standards around experienced and highly qualified advisors.

Questions I would ask an advisor

I’ve created a questionnaire for you to use when speaking to an advisor that you might want to pay for advice. I’ve run it past a couple of advisors to make sure that the questions are helpful, relevant and fair to both parties.

You can download it with the book which also comes with the full platform review, the full audiobook, and a budget tool. The book is what pays for this website – there are no adverts or sponsorships and nothing is written to please any company (I’ve angered quite a few in fact). The book costs £15 and is the only income I’ll have had since I starting putting this book and website together in 2022. Please consider it.

Next steps

Once all of these things are complete, my next step would be to read the introduction to Investments – setting them up. That outlines the different steps that I go through.