Medium level of risk and potential returns

Your responses indicate an appetite for investments that carry a MEDIUM level of risk and potential returns.

(This score is intended and must only be used for information and illustrative purposes.)

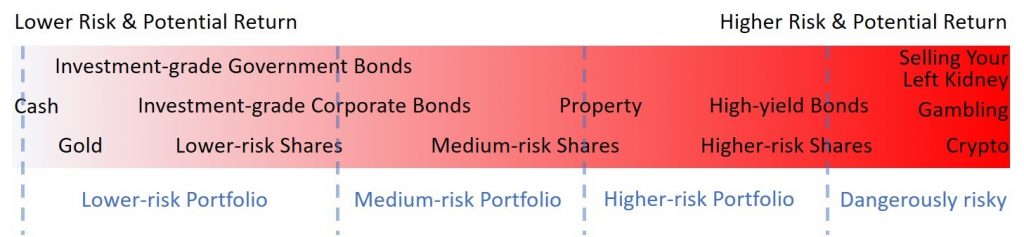

Medium-risk investments tend to have balance between short-term movements in price (both down and up) i.e., volatility and their potential for growth over the long term (eight or more years) tends to be higher. Higher-risk investments tend to have more volatility and higher potential returns, while lower-risk investments tend to have less volatility and lower potential returns.

For more information about these asset classes and how why they might be useful, visit the Asset Classes Explained page.

To see how my preferred lower-, medium- and higher-risk portfolios differ, visit the Portfolios I Copy page.

You can do the questionnaire again or get a hard copy of the survey which is included in the book.