Performance and Costs

On this page, I provide updates on the performance and costs of the example portfolios I’ve set up using my own money.

Click on the green links to jump to the relevant portfolio.

£10,000 Higher-Risk Rated Portfolio

£50,000 Higher-Risk Rated Portfolio

£10,000 Medium-Risk Rated Portfolio

£50,000 Medium-Risk Rated Portfolio

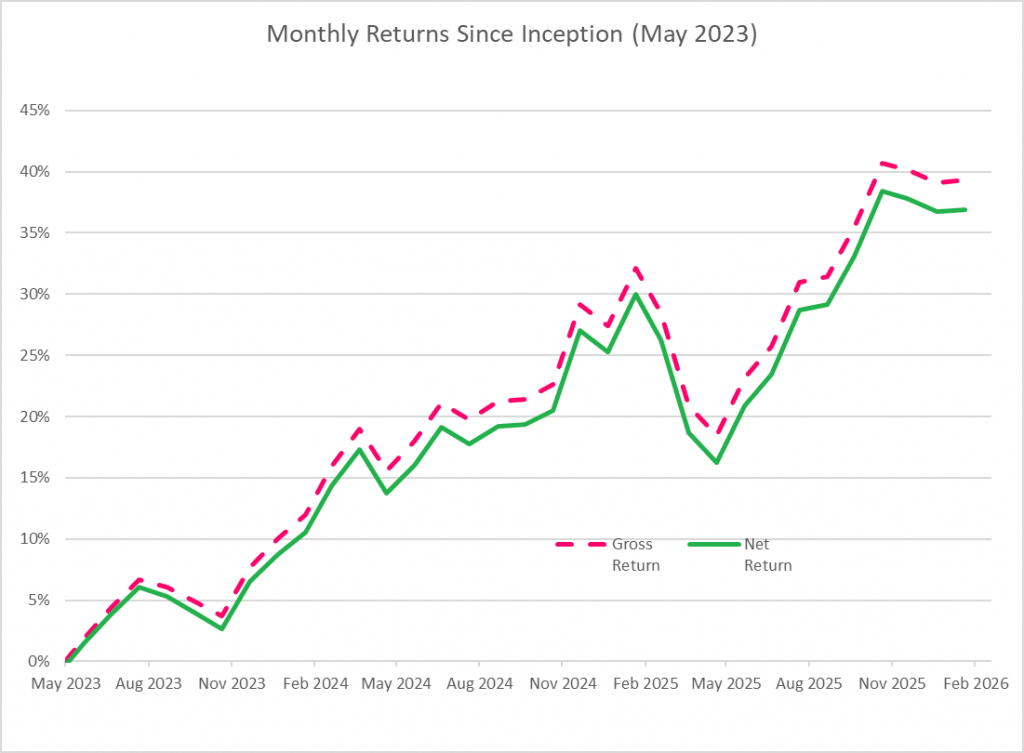

£10,000 Higher-Risk Rated Portfolio

Data sourced from Refinitiv Eikon and David Ryder.

As I predicted, the performance has fallen a little. It had too, it was too high. The 36.92% return after fees is still very good for 21 months, and I won’t be at all surprised if performance continues to stagnate or fall while the geopolitics of Ukraine-Russia, US-everywhere else, Israel-Palestine play out.

Data sourced from Refinitiv Eikon and David Ryder.

Return to the top of this page

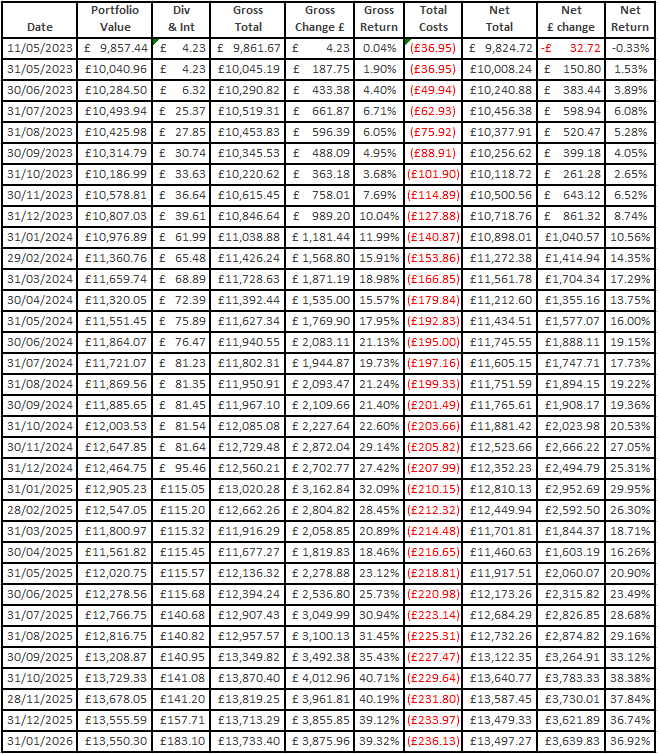

£50,000 Higher-Risk Rated Portfolio

Data sourced from Refinitiv Eikon and David Ryder.

Return to the top of this page

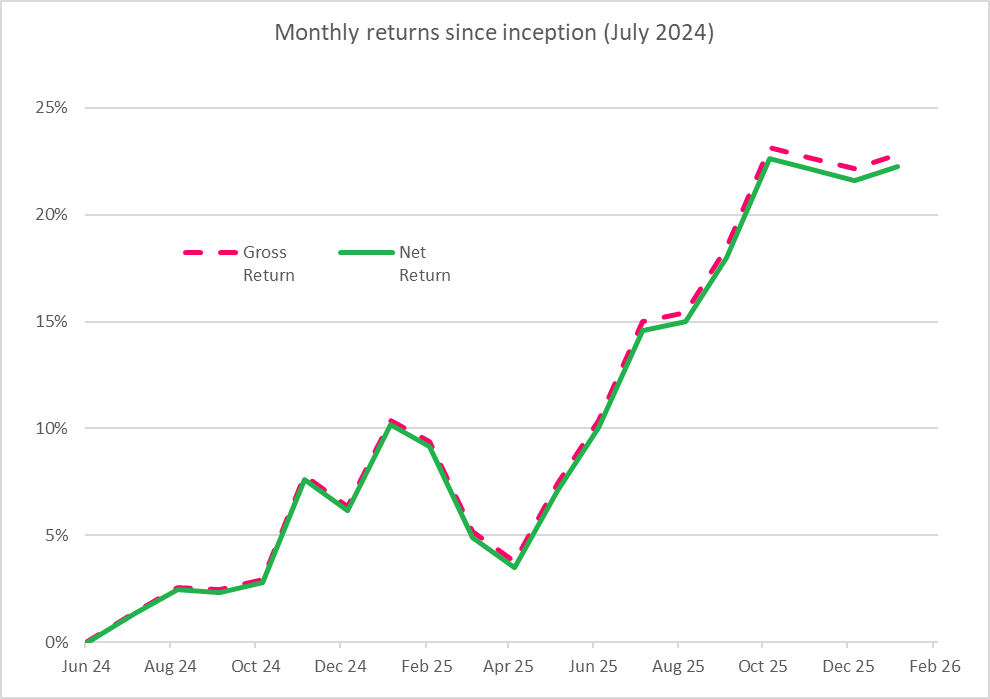

£10,000 Medium-Risk Rated Portfolio

Data sourced from Refinitiv Eikon and David Ryder.

Return to the top of this page

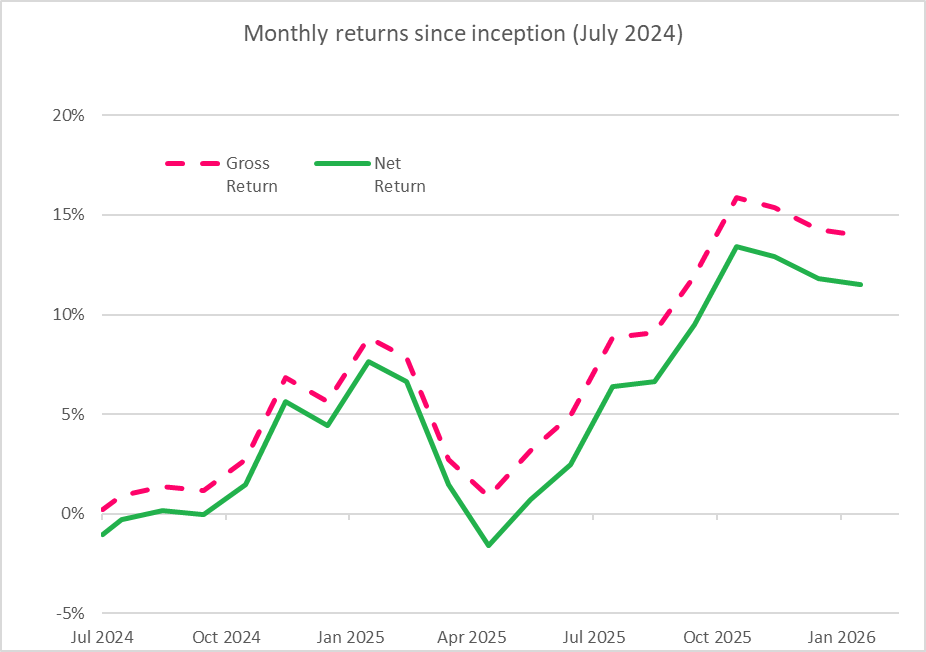

£50,000 Medium-Risk Rated Portfolio

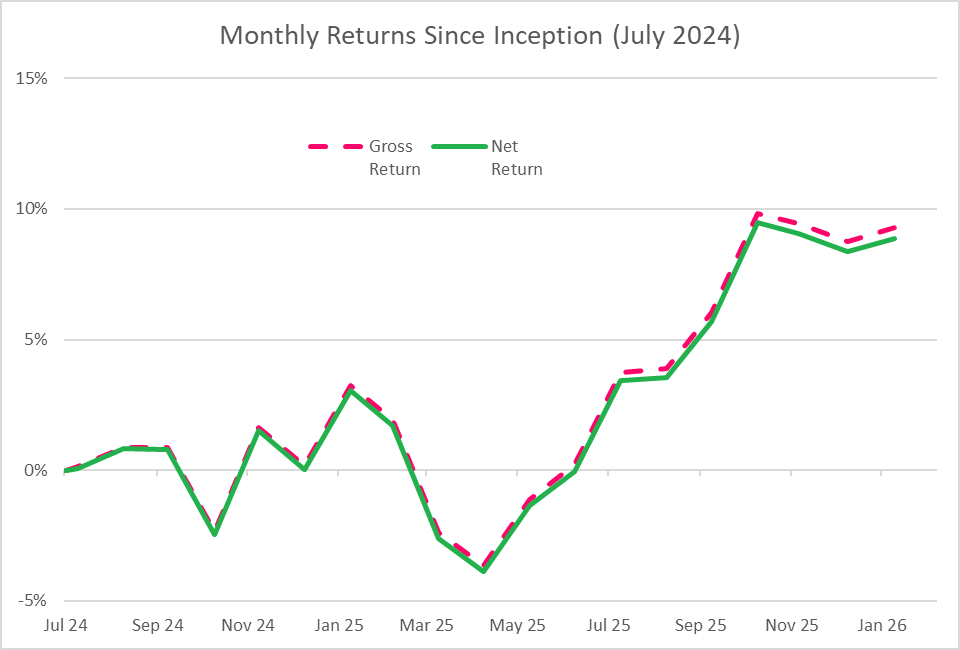

Data sourced from Refinitiv Eikon and David Ryder.

This medium-risk portfolio provides a good contrast to the performance of the higher-risk portfolio at the top of this page.

Between February and May 2025, the higher-risk portfolio lost almost 15 percentage points in value and since added 20 percentage points in value. Over the same period the medium-risk portfolio lost only 8 percentage points and since added 13.

This is not an entirely scientific comparison, but it gives a useful indication of what is meant by “risk”, i.e., the speed and severity of price movements.